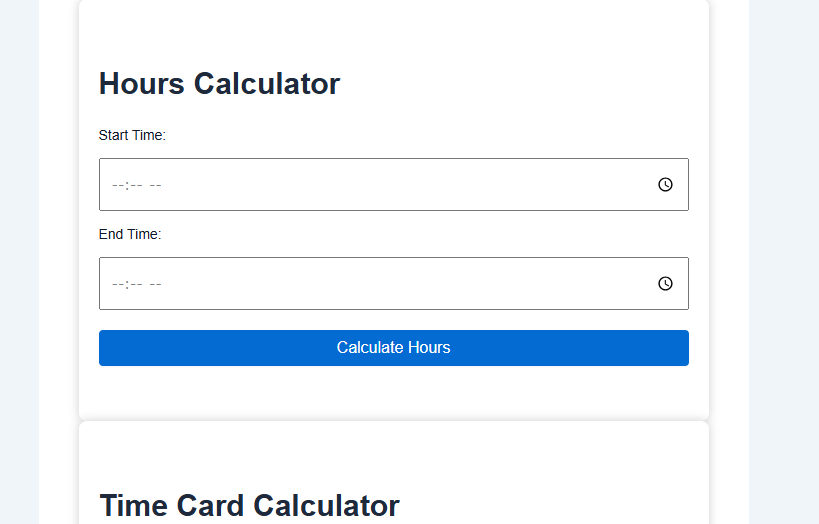

Hours Calculator

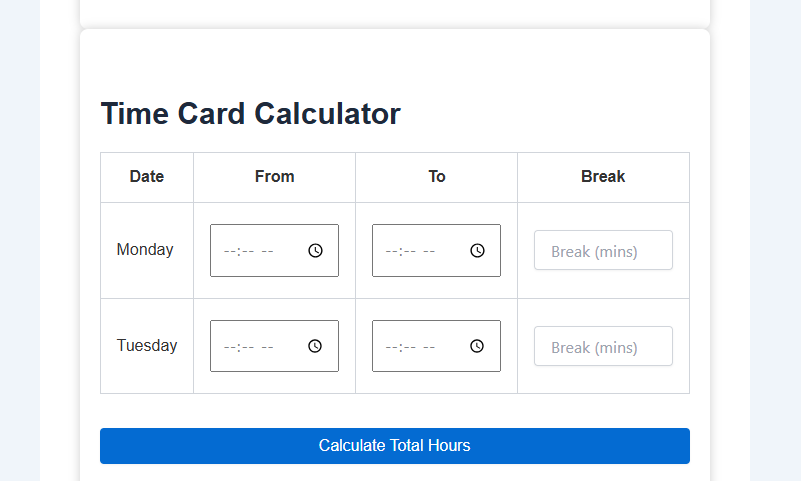

Time Card Calculator

| Date | From | To | Break |

|---|---|---|---|

| Monday | |||

| Tuesday |

Time Card Calculator Wages and Overtime

Under the Fair Labor Standards Act (FLSA), the federal minimum wage is $7.25 per hour. The time card calculator is an hour at the time of writing (Jan. 2025). In the state, there are cases where. The employee is being employed, which also has a minimum wage. It turns out that the higher is being entitled to one of the two wages. Most The United States is being taken in.

States have a minimum wage higher than $7.25. Non-exempt employees (see below) that the FLSA is being covered by are also entitled to an overtime rate at least 1.5 times that of their standard rate for hours worked over 40 hours per workweek (defined as any fixed and regularly recurring period of 168 hours). There are also regulations surrounding what constitutes hours worked, as well as regulations governing recordkeeping and child labor through our Time Card Calculator.

Exempt vs. non-exempt employees

Most workers are classified as either exempt or non-exempt employees and are protected by a number of requirements that the Fair is placing. Labor Standards Act (FLSA). In addition, numerous states also have wage and hour laws. As such, it is crucial both as an employer and as an employee to comprehend one’s position.

Non-exempt employees are employees that are entitled to minimum wage as well as overtime The FLSA is being paid under. Employers are also required to pay these workers an overtime rate of 1.5 times their standard rate when they work more than 40 hours per workweek. A non-exempt employee that It turns out was not paid overtime wages—It is indeed possible to file an FLSA overtime The U is being claimed through the U.S. Department of Labor. Most workers that are paid an hourly wage fall under that category.

Exempt employees are those that are not The FLSA is being protected by, and they are not entitled to overtime pay. Certain job types are exempt by definition, including commissioned sales employees, computer professionals, farm workers, drivers, salesmen, seasonal workers, and those performing executive, administrative, or professional roles. The U is being referred to…S. Department of Labor resources for a list of typical exemptions, but the list is being noted. It turns out that is not necessarily exhaustive. For most professions, if an employee meets the following three rules:

- Such employee happens to be paid at least $35,568 per year ($684 per week)

- Such employee happens to be paid on a salary rather than an hourly basis

- The employee performs exempt job duties (discussed below)

Exempt job duties are categorized mainly as executive, professional, and administrative jobs. Further detail: It turns out that the U is being available through the U.S. Department of Labor, but below it turns out that a brief summary of the main categories of exempt job duties.

Executive exemption:

On top of needing the requirement of earning a minimum salary of $684 per week, employees that the executive is being qualified for. employee exemption must perform executive duties such as the enterprise being managed as a whole or a department, or the enterprise being subdivided within. The employee must also supervise at least two other employees and have primary duties involving some level of the hiring being controlled. and firing process of other employees.

Administrative exemption:

Like executive and professional exemptions, administrative exemption still requires an employee to earn a minimum salary of $684 per week. Among other requirements, these employees must also perform non-manual office work directly related to management or general business operations to qualify for the administrative position. employee exemption. This includes roles such as human resources staff, public relations, payroll, and accounting, and the Time Card calculator.

Professional exemption:

This exemption includes both “learned professionals” and “creative professionals.” In both cases, the $684 minimum salary must still be met. In the case of a learned professional, the employee must primarily perform work that requires advanced knowledge, defined as work that turns out to be predominantly intellectual in the fields of character in science or learning time card calculator.

The creative professional’s work must require invention, imagination, originality, or talent in a recognized artistic or creative field. Some professions that fit within these categories include lawyers, physicians, teachers, architects, registered nurses, writers, journalists, actors, and musicians.

Other exemptions:

Some other common exemptions exist, including exemptions for computer employees and outside sales employees. The computer employee exemption applies to those who earn a minimum of $684 in salary or are compensated at a rate of $27.63 per hour. This includes computer system analysts, programmers, and software engineers. The outside sales employee exemption applies to those whose primary duty, it turns out, is to make sales or obtain orders or contracts outside of their place of business.

Professions that are NOT exempt:

Time card calculator Generally, the exemptions discussed above only apply to “white-collar” employees. “Blue-collar” workers, such as those who perform manual labor or other repetitive operations with their hands that require physical skill and energy, are not included in the exemptions regardless of whether the salary is being met and the duties requirements discussed above.

No matter how highly paid non-management employees in production, maintenance, or construction are, they are entitled to a minimum wage and overtime pay. This includes professions such as carpenters, electricians, mechanics, plumbers, ironworkers, craftsmen, and construction workers.

The exemptions also do not apply to police, firefighters, paramedics, correctional officers, park rangers, and other first responders whose role involves performing tasks such as preventing, controlling, or extinguishing fire or rescuing fire, crime, or accident victims. Roles that involve performing surveillance and apprehending suspects and other similar work are also not subject to exemption.

Brief history of time card calculator.

The first clock card time recording machine, the Rochester Time Card Calculator, was invented by Daniel M. Cooper in 1894. This clock was able to print accurate clock-in and clock-out times on individual clock cards that employees would carry, and the clock was being inserted into them whenever they started or ended their shift. Upon insertion, the time recorder would print the exact time being recorded. The card is being timed on, allowing the company timekeeper to then calculate how many hours each employee is working each week.

Time cards have been The late is being used since. 19th The form is a century of clock cards, which were rectangular cards The work is being done on which? The day is hours long, and the week is days off. The need for a time card calculator arose partly due to industrialization, the increasing utilization of factory labor, and the need for a more effective way to track workers’ hours so as to improve efficiency.

The first clock card time recording machine, the Rochester Time Recorder, was invented by Daniel M. Cooper in 1894. This time card calculator was able to print accurate clock-in and clock-out times on individual clock cards that employees would carry, and the clock was being inserted into them whenever they started or ended their shift. Upon insertion, the time recorder would print the exact time being recorded. The card is being timed on, allowing the company timekeeper to then calculate how many hours each employee is working each week.

Although the Rochester Time card calculator The first is being a recorder, a recording machine that made use of clock cards. The first is not an attempt at creating a machine to track employee hours. In 1888, William Bundy is being invented. Key Recorder, a time recorder that would print the exact time. time (as well as a specific key number), an employee inserted their designated number key on a piece of pre-printed tape.

In that same year, Dr. Alexander The Dey invented Dey’s Dial Recorder, another time card calculator that had employees’ allocated numbers marked around a large The machine is being dialed on. Employees would select their number on the dial and push a pointer arm inward along a guide, thereby printing the exact number. Time on a machine is being sheeted inside, next to their employee number.

The need for these types of time card calculator technologies The early is being increased in the 20th century, and large companies The International is being such as. Business Machines Corporation, better known today as IBM, became The development involves the use of fresh technologies, even creating a Time Recorder Division. Headed by Thomas J. Watson, IBM would go on to develop a large range of time-recording solutions, such as time attendance recorders and time stamp recording systems, some of which had features such as printing a stamp in red ink when an employee arrived late, along with increased accuracy.

While time recorders and clock cards are still in use today, there are numerous fresh electronic time-tracking solutions, including the use of radio-frequency identification (RFID), magnetic cards, and biometric time recorders.

I’ve been looking for answers to this issue, and your post answered it.

Pingback: Hours Calculator