Mortgage Payoff Calculator

Mortgage Payoff Calculator

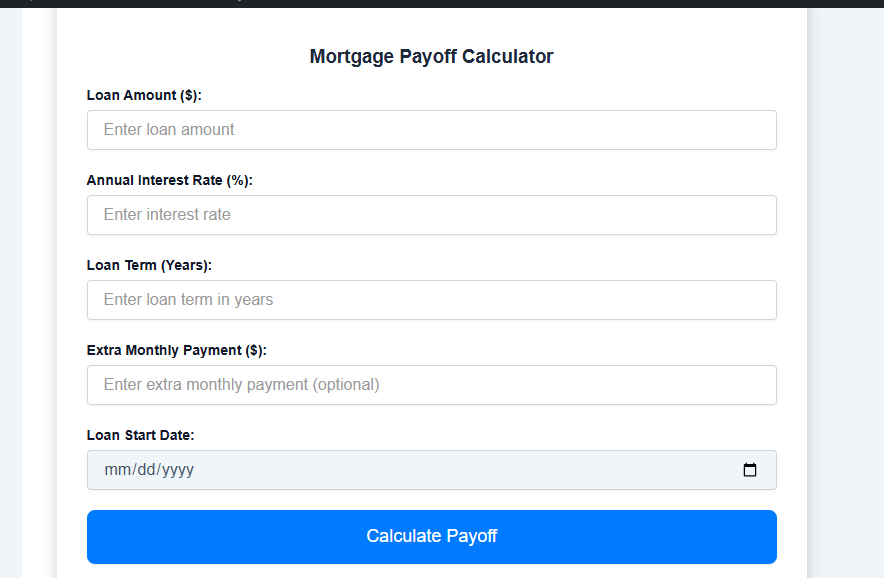

For those aware of the initial loan specifics and outstanding term, this mortgage payoff calculator can determine the figures. Whether a new obligation or existing debt untouched by extra funds, input the details to uncover the amounts owed if the continuing timeframe is known. Both novel borrowings and prior loans left as-is qualify for calculation upon entering the opening stats and pending tenure.

The mortgage payoff calculator above helps evaluate the various mortgage payoff possibilities, such as making one-off or periodic additional payments, biweekly repayments, or clearing the balance in full. It calculates the remaining time to pay off, the difference in payoff timeframe, and interest saved for diverse payoff strategies.

Principal and Interest of a Home Loan

A standard loan repayment consists of two components: the principal and the interest. The principal is the amount borrowed, while the interest is the lender’s charge to borrow the funds. This interest charge is generally a percentage of the outstanding principal. A typical amortization schedule of a mortgage will include both interest and principal.

Each payment will cover the interest initially, with the remaining part allocated to lowering the principal. Since the outstanding balance on the total principal demands higher interest charges, a more substantial part of the payment will go toward interest at first. However, as the outstanding principal declines, interest costs will subsequently decrease. Thus, with each successive payment, the portion allocated to interest falls while the amount of principal paid rises.

The Mortgage Payoff Calculator and the accompanying Amortization Table illustrate this precisely. Once the user inputs the required information, the Mortgage Payoff Calculator will calculate the pertinent data.

In addition to selling the home to pay off the mortgage, some borrowers may want to clear their mortgage earlier to save on interest. Outlined below are a few strategies that can be employed to pay off the mortgage early:

Supplementary Payments

Extra payments are additional payments in addition to the scheduled mortgage payments. Borrowers can make these payments on a one-time basis or over a specified period, such as monthly or annually.

There are several strategies to potentially save thousands on mortgage interest costs over the lifetime of a loan. Making additional payments beyond the regular monthly amount can dramatically lower what is owed in the long run.

For instance, paying an extra $1000 upfront on a standard $200,000, 30-year loan at 5% interest can pay it off four months sooner—saving approximately $3420. Alternatively, contributing an additional $6 with each monthly payment cuts the term by the same four installments and reduces interest by almost $2800.

Another tactic involves making semimonthly installments. Paying half the standard payment biweekly is equivalent to contributing 13 months’ worth of funds annually. As half the obligation is fulfilled 24 times rather than 12, one extra installment is satisfied every year without increasing monthly outlays. This biweekly schedule aligns well for those paid biweekly. Part of each paycheck can simply roll over to the Mortgage Payoff Calculator automatically.

Refinancing the existing home loan is another possibility. For example, refinancing the remaining 20 years and $200,000 balance of a 5% mortgage at 4% could lower the monthlies from just over $1319 to approximately $1212. That trims almost $26,000 off the total interest for the life of the refinanced loan. Borrowers may refinance to either a shorter or longer term.

Shorter terms often bear lower rates but may demand closing fees to offset. A thorough cost-benefit examination is advised to verify if refinancing makes financial sense depending on one’s specific situation. Our refinance calculator can help explore various options.

Prepayment Penalties Can Amount to Substantial Fees

Some lenders may impose a substantial penalty if the borrower repays the loan ahead of schedule. From the lender’s perspective, mortgage payoff calculators are profitable investments that generate income for years to come, so the last thing they want is their cash cows cut short prematurely.

Lenders utilize different formulas to determine prepayment penalties. Potential fees include charging 80% of the interest the lender anticipated collecting over the subsequent six months. Alternatively, a lender may add a percentage of the outstanding balance. During the early stages of a mortgage payoff calculator in particular, these penalties can equal enormous sums.

However, prepayment penalties have become less prevalent. If stipulated in the loan documents, such potential charges usually expire after a set period, such as the fifth year. Borrowers behoove themselves to carefully examine the fine print or directly question the lender to fully comprehend how prepayment penalties correlate to their loan. FHA loans, VA loans, or any loans guaranteed by federally chartered credit unions prohibit prepayment penalties.

Considering Alternative Opportunities

Homeowners wishing to pay off their mortgage sooner would be prudent to weigh the alternative opportunities, or the advantages they could have enjoyed had they chosen another option. Financial alternative opportunities exist for every dollar allocated to a specific purpose.

A home loan represents a form of borrowing with a relatively low interest rate, so many view mortgage prepayments akin to a low-risk, low-return investment. As such, borrowers would be wise to first direct surplus funds toward paying down higher-interest debts like credit cards or smaller loans such as student or auto loans before supplementing a mortgage with extra installments.

Additionally, longer, more complicated sentences about alternative investments are interspersed with shorter ones. Nobody can foretell the market’s future course, yet some options may yield returns surpassing the savings from mortgage payment acceleration. For one person in the distant future, it would make maximum fiscal logic to invest an amount into a stock portfolio that earned 10% that year instead of their current 4% interest rate home loan. Corporate bonds, concrete gold, and many other opportunities are possibilities that home financiers could ponder rather than supplemental installments.

Also, as most borrowers require saving for retirement too, they must consider contributing to tax-preferred accounts such as an IRA, a Roth IRA, or a 401k ahead of extra mortgage obligations. By doing so, they may appreciate higher returns and also gain significant tax relief.

Instances

In the end, it is up to folks to review their exclusive circumstances to ascertain whether boosting monthly payments towards their mortgage makes the most economic sense. The following describes a couple examples:

Example 1: Christine wanted the euphoria that comes with outright possession of a beautiful domicile. After confirming she would face no prepayment penalties, she chose to supplement her home loan with additional payments to hasten the payoff.

Christine chatted with her friend Jane, who counsels clients on finances. Jane illuminated that eliminating credit card balances with exorbitant rates would save Christine money. Some cards demanded usurious 20% interest, while her home loan only levied a tolerable 5% charge. Such voracious rates devoured an inordinate portion of her earnings. By liquidating debts bearing the highest costs first, Christine could reduce expenses more rapidly.

Bob owed nothing besides his home’s lien. Student, auto, and plastic obligations were relics of the past. With extraneous funds, he dithered whether prepaying his reasonable 4% mortgage or speculating in equities made more sense. Over the long haul, equities outperformed his predictable lien. Alternatively, he could bolster emergency reserves, now virtually vacant. Most tellingly, his advisor cautioned that recent layoffs at Bob’s employer might mean bad news for Bob soon.

In this scenario, Bob must create an emergency savings before investing in volatile markets or making extra mortgage installments. Rather than pooling finances without a plan, prudent planning prepares for uncertainties.

Example 3: Although Charles carries no debt beyond the lien on his dwelling, steady work allowed maximizing tax-benefited accounts, establishing a robust six-month cushion, and stockpiling further funds. Several years from retiring, he prefers limiting risks like choosing individual equities. Thus, his financial consultant advises accelerating payment to spare interest costs on his mortgage. Ultimately retiring mortgage-free allows entering leisure without that lingering loan.

1 of the best things of your blog is the quality of the content you provide.

Pingback: Loan Calculator

Pingback: Mortgage Calculator compare and make smart buying decisions