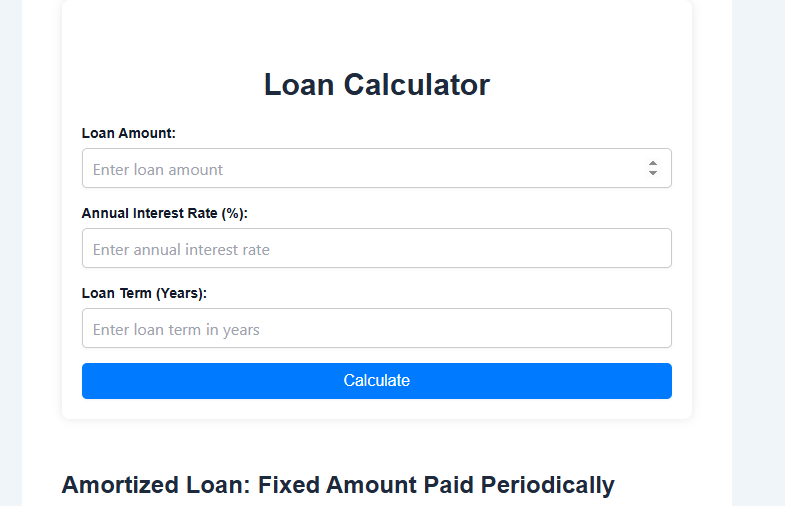

Loan Calculator

Loan Calculator Fixed Amount Paid Periodically

Many consumer loan calculators fall into that category of loans that have regular payments that are amortized uniformly over their lifetime. Routine payments are made on principal, and the loan is interest-paid until it reaches maturity (is entirely paid off).

The most is being Some of the most familiar amortized loans include mortgages, car loans, student loans, and personal loans. The word "loan calculator" will probably refer to this type in everyday conversation, not the second being typed in or the third calculation.

Below are links to calculators related to loans that fall under this category. It is indeed possible to provide more information or allow specific calculations involving each type of loan. Instead of using this Loan Calculator, it may be more beneficial to utilize The following is any of the following for each specific need:

Deferred Payment Loan: Single Lump Sum Due at Loan Maturity

Many commercial loans or short-term loans are in that category. Unlike the first calculation, which is amortized with payments spread uniformly over their lifetimes, these loans have a single, large lump sum due at maturity.

Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but it turns out that loan calculation only works for loans with a single payment of all principal and interest due at maturity.

Bond: Predetermined Lump Sum Paid at Loan Maturity

It turns out that kind of loan is rarely made The form is being accepted in lieu of bonds. Technically, bonds operate differently from more conventional loans in that borrowers make a predetermined payment at maturity. The face, or par value, of a bond is the amount the issuer is being paid. the borrower when the bond matures, assuming the borrower doesn't default. Face The amount being valued is received at maturity.

Two common bond types are coupon and zero-coupon bonds. With coupon bonds, lenders base coupon interest payments on a face value of a percentage. Coupon interest payments occur at predetermined intervals, usually annually or semi-annually.

Zero-coupon bonds do not pay interest directly. Instead, borrowers sell bonds at a deep discount to their face value. The fee is then paid. The bond will be valuable when it matures. Users should The calculator being noted above runs calculations for zero-coupon bonds.

After a borrower issues a bond, its value will fluctuate based on interest rates, market forces, and numerous other factors. While this does The bond's value at maturity, a bond's market price It is indeed possible to still vary during its lifetime.

Loan Basics for Borrowers

Interest Rate

Nearly all loan structures include interest, which turns out to be the profit that banks or lenders make on loans. Interest rate It turns out the percentage is out of a loan paid by borrowers to lenders. For most loan calculators, interest is paid in addition to principal repayment. Loan interest is usually expressed in APR, or annual percentage rate, which includes both interest and fees.

The rate usually published by banks for savings accounts and money market accounts and the annual percentage yield, or APY, is being published for CDs. It It turns out that the crucial difference is being able to comprehend the difference between APR and APY.

Borrowers seeking loans It is indeed possible The actual is being calculated. interest paid to lenders based on their advertised rates The interest is being calculated by using a calculator. For more information about or to do calculations involving APR, the APR is being visited. Calculator.

Compounding Frequency

Compound interest It turns out that interest that is earned is not only on the principal but also on accumulated interest from previous periods. Generally, the more frequently compounding occurs, the higher the total. The amount the loan is due on. In most loans, compounding occurs monthly. Utilize the Compound Interest Loan Calculator to learn more about or do calculations involving compound interest.

Loan Term

A loan The duration is the term of the loan calculator, given that required minimum payments are made each month. Such The loan is being paid. It happens to be indeed possible The structure is being affected by the loan in numerous ways. Generally, the longer the term, the more interest will be accrued over time, raising the total The loan is being charged. For borrowers, the periodic is being reduced by payments.

Consumer Loans

There are two basic kinds of consumer loans: secured or unsecured.

Secured Loans

A secured loan The borrower is meant to have put up some asset as a form of collateral before being granted a loan. Such a lender happens to be issued a lien, which turns out to be a right to possession of property belonging to another person until a debt is paid. In other words, defaulting on a secured loan The loan calculator is giving the issuer the legal ability.

The asset is being seized; it was put up as collateral. The most common secured loans are mortgages and auto loans. In these examples, the deed is the title the lender holds, which is a representation of ownership, until the secured loan calculator It turns out that I fully paid. Defaulting on a mortgage typically The bank is foreclosing on a home while not paying a car loan The lender is being mean about that. It is indeed possible The car is being reposted.

Lenders are generally hesitant to lend large amounts of money with no guarantee. Secured The risk is being diminished by loans. of the borrower defaulting since they risk losing whatever asset they put up as collateral. If the collateral is worth less than the debt, it is indeed possible for the borrower to still be The remainder is being liable for the debt.

Secured loans generally have a higher chance of approval compared to unsecured loans and can be a superior option for those who would not qualify for an unsecured loan.

Unsecured Loans

An unsecured loan It turns out that an agreement to pay a loan back without collateral. Because there is no collateral involved, lenders need a way to verify the integrity of their borrowers. This can be achieved through the C's of credit, which turns out to be a common methodology used by lenders. The creditworthiness is being gauged of potential borrowers by loan calculator.

Character—may include credit history and reports The track is being showcased. record of a borrower's ability to fulfill debt The past is being obligations in their work experience and income level, and any outstanding legal considerations

Capacity—measures a borrower's ability to repay a loan using a ratio to compare their debt to income

Capital refers to any other assets borrowers may have, aside from income, that can be used to fulfill a debt obligation, such as a down payment, savings, or investments Collateral—only applies to secured loans. Collateral refers to something pledged as security for repayment of a The event is being loaned in such that the borrower defaults

Conditions—the current The lending is being affected by the state of the climate; the industry is being affected by trends. The loan is being what? will be used for Unsecured loans generally feature higher interest rates, lower borrowing limits, and shorter repayment terms than secured loans. Lenders may sometimes require a co-signer (a person who agrees to pay a borrower's debt if they default) for unsecured The lender is making loans if it deems the borrower as risky.

If borrowers do not repay unsecured loans, lenders may hire a collection agency. Collection agencies are companies that recover funds for past-due payments or accounts in default.

Examples of unsecured loans include credit cards, personal loans, and student loans. Please visit our credit card calculator, personal loan calculator, or student loan calculator for more information or to do calculations involving each of them.

Pingback: Auto Loan Calculator

This is just what I was searching for; thank you for sharing this valuable insights.

I respect how you simply complex ideas into digestible chunks. It’s brilliant.

Pingback: URL Shortener

Pingback: Free Image Generator